I was idly wondering why it is that a country rich in natural resources seems generally to be poor and discover there is a descriptive term for this in economics. I went on to discover that there is an established connection between being rich in resources—which typically are then mined and sold—and economic disbenefits. That this is not universally true leads to more questions, explored here.

Dutch disease

Not to be confused with dutch elm disease, this phrase was coined after the discovery of significant natural gas in Groningen in 1959. As the country sold gas abroad, so the currency became stronger, damaging other exports and surprisingly leading to a recession.

In brief and in economic terms, tradable goods become less competitive as the currency appreciates. In compensation typically governments must spend to artificially create employment. The increased revenue is often spent on health, welfare, military, and public infrastructure, and if this is done corruptly or inefficiently it can be a burden on the economy.[1] The nation also becomes susceptible to changes in the price of the resource being sold, which has other knock-on effects.

First, the established observation and some examples. Way back in 1993, following on from cold-war era arguments about low-income countries. Richard Auty produced the term; the counter-intuitive result of that study was that countries had lower economic growth than countries without an abundance of natural resources. [1]. [2] suggests that resource wealth tends to harm economic growth, yet there is little agreement on why this occurs… It suggests that much has been learned about the economic problems of resource exporters but less is known about their political problems. The disparity between strong findings on economic matters and weak findings on political ones partly reflects the failure of political scientists to carefully test their own theories. I conclude that there is an observed connection between the politics before and after where a nation state has mined resources and the extent to which this damages median income. It seems [1], for example] that tapping into resources in a relatively undemocratic state tends to make it less likely to become more democratic and the reasoning basically says that the money garnered first goes through the hands of those in power, who ten use that to shore up their own interests. In a strongly democratic society this occurs to a far weaker extent, but is still seen as reducing incentives to strive.

[I encourage you to read about this for yourself, treating my source list as a reading list] Examples you might know about already would include: DRC (Zaire as was), diamonds; Angola, diamonds and oil; Venezuela, oil; NE USA, coal; Afghanistan, many mined minerals and in consequence a space to watch.

The counter-example nation is Norway, who hit it rich, so to speak, with the discovery of North Sea Oil. It managed to escape, mostly by managing the revenues and the ways in which those revenues impacted the economy as a whole. Another is Botswana (See [3] for both of these). You can understand how easy it is for the state powers to take money (state revenue) from the resource being sold and in turn reduce what it collects from the people in taxation. It seems that a far more healthy attitude is to do something more like give a transparent dividend directly to the citizenry as funds and then collect it back through taxation, as this will stimulate the economy. It also includes everyone directly instead of indirectly and (apparently) avoids the traps that the resource sale brings.

Of course, having discovered a resource one is not required to bring it out of the ground. The world market may make this unprofitable (Cornish gold and tin, or coal across most of Britain are currently better left where they are) and one might choose to release the equity slowly rather than headlong, as perhaps is occurring in Saudi Arabia this decade.

There appear to be four models for the resource curse:

1) The Dutch disease, where production is lost because the currency appreciates (because the new industry demands high wages, so bringing inflation) and in turn the manufacturing sector shrinks; this slows down economic growth. Some would blame this on investors. The argument is that whatever it is (perhaps traded manufactured goods) that is driving growth, it is driven out to an extent by natural resources.

2) The centralised political economy, where patronage and its like mean that the resources of people and investment are largely wasted. for which the finger can be squarely pointed at the government. In these cases we would expect to see grand and eye-catching edifices built where spending on infrastructure would be more useful, nationally. This correlates well with what the politicians call weak institutions and historians call authoritarian regimes. The identified problem in these models is described as patronage, so that the resources are spent to the immediate benefit of the political elite, such as staying in power. The same people could choose to spend resource to improve private sector (non-state) profitability. The observed worst case is to reduce to fighting political opponents (as we see often in Africa) in many ways. As [3] quotes (3.3.2) natural resource wealth tends to inhibit democratic development because the resource rents help regimes conserve their power.

Economic Rent

Payment to a producer / owner in excess of the production costs. The recipient is a rentier. Hence we have a rentier state, one which derives all or a substantial portion of its national revenues from the rent of indigenous resources to external clients. [wikipedia]. Examples in petroleum would be most of the Gulf states, the oil producers in Africa (west and north coasts) and in Latin America. Such states typically gain state revenue from the resource rather than from the citizenship.

At its simplest, think of this as me owning land with coal and renting the volume to you so you do the mining; all I do is sit back and collect. Tempting, isn’t it?

3) The decentralised version, where the rentier economy encourages unproductive economic activity, and for which we might blame the entrepreneurs. The ‘rent-seekers’ in this case are outside the political elite and are competing for the rights to the rent rather than something productive or entrepreneurial. So for example an institution referred to as ‘grabber-friendly’ will encourage entrepreneurs into influence activity rather than production (politicking rather than manufacturing). Institution is this sense means law/justice systems and bureaucracy that work poorly and allow or support corruption; the scheme of rules by which people operate. That would include weak property rights, weak contract law and contractual rights. These weak institutions typically help the elite and at the same time disbenefit the population as a whole and the growth of the economy. More of this in what is going to be the next essay, as it occurs to me that this describes what is wrong with our financial institutions ‘the City’) in Britain. No doubt I will also find that The Guardian has a Long Read on the very topic in an adjacent weekend. Countries with good institutions correlate well with, in general, better economic growth ([3], 3.4.1, but there are exceptions, so this is not a controlling factor)

4) the boom and bust cycle applies to all three models as all are vulnerable to hight price volatility (paraphrasing [3])

Further reading suggests that the resources one should concentrate on are in some sense point source resources, geographically localised. The opposite, diffuse resources spread across a nation (e.g., Ghana’s cocoa crop), seem to stand up to scrutiny less well, which may mean that the facets of greed—that give us the curse— fail to win out when the source is diffuse.

What we’re discussing here is all to do with greed and short-term return. I see the rent-seeking, as the economists term it, as the temptation to become the idle rich. Yet the resource can only be mined once; once it’s gone, it’s gone. So that means that the long-term view has to be not instant gratification but for this sale of resource to provide a step up in terms of development. As discussed in earlier essays, the objective of nations is (apparently) to raise the economic growth and that virtually all models of any successful nation are predicated upon that. I have deplore that associated assumption of ever-increasing population and we see from this topic and the likelihood of global warming (and the consequences of that) that we really do need to make intelligent choices, while at the same time it looks increasingly as if we are incapable of exactly that. We need to look hard at places like Norway and determine what parts of what they do we are prepared to work for. At an individual level we need to find balance in a similar way; that seems to me to require a clarity of thought and a sense of both individual and collective responsibility not at all common in out current society. The currency of short-term goals runs counter to any ideas of long-term objectives. We expect our governments to do this thinking for us, but while politicians too are forever chasing short-term results, this is not going to happen. Which means that whatever passes for an intellectual class is left in the role of trying to persuade the greedy to see objectives that serve us all for the better. Short-termism works against such thinking.

DJS 20181007

top pic from The East African, 20130629

Relevant other essays generally on population include 208, 240, 241, 175, 173

[1] https://en.wikipedia.org/wiki/Resource_curse

[2] https://www.cambridge.org/core/journals/world-politics/article/political-economy-of-the-resource-curse/EBEA5E178E7534C4BA38EE23D25322E0

[4] http://www.thenational.ae/business/industry-insights/economics/ dubai-shows-way-to-diversify-economies Arnold, T. (20120711).

[5] https://www.soas.ac.uk/cdpr/publications/dd/file48462.pdf

[6] https://econfix.wordpress.com/2017/01/12/sub-sahara-economies-hit-by-fall-in-commodity-prices/

Oil was found off Norway in the early 60s. GDP per capita compared to the OECD average was 5% below in 1970 and 70% above in 2010. 2012 figures show Norway 4th highest GDP per capita [3]. Norway is stable, mature, parliamentary democracy, it has little corruption, strong institutions in the sense used earlier and an active press making comment. It classes as having good governance, around 95% (look at WGI and here). Norway has one of the highest GDP per capita in the world, because they succeeded in turning petroleum revenue into human capital. That last now accounts for 82% of national wealth, compared to 7% for petroleum activity. (Source [4]) Human capital: investing in education, moving more people into the workforce, supporting productivity growth. The other thing Norway did was diversify, meaning supporting work different from petroleum—you could view this as using the windfall to ensure the future stayed better. So Norway is the second-largest exporter of seafood, the sixth-largest exporter of aluminium and the leading exporter of sub-sea technology and products.[4]. The same source points to Dubai trying hard to follow Norway’s example.

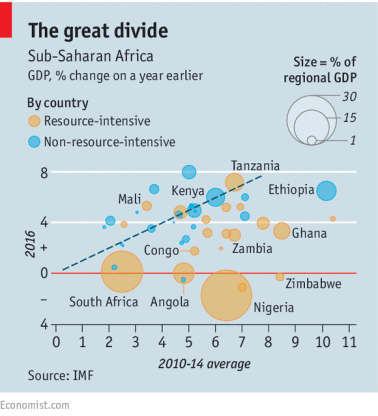

Botswana produces a lot of the world’s diamonds. In 1966 it was one of the poorest states in the world. In 1966 half the government spending was covered by Britain. By 2010 it can be seen that diamonds have accounted for about 40% of GDP since 1980. Real GDP per capita has grown steadily. Diagram from [3], section 2.5 figure 2, developed from figures from the World Bank. Botswana is a multiparty democracy, though the BDP has been in power since independence, e.g. 45/57 seat in the 2009 election, so it’s pretty near to looking like an autocracy [3]. WGI index around the 70% mark (South Africa similar but lower, especially in the stability index; Nigeriia around 20%). Botswana is worthy of further study; it has an accountable, transparent bureaucracy, several provably independent bodies providing the necessary check and balance. Of all of Africa, only the RSA gets close on the WGI indicators. Like I said, more study needed, even a visit. The diagram labelled the Great Divide has Botswana unlabelled, but I think it is the blue dot on the 8% line, since [3] tells me average real GDP growth was 8% from 1976 to 2008. However, we should note that Botswana has largely failed in its attempts to diversify in terms of industry, while it has succeeded in raising productivity by attention to human capital, health and infrastructure. HIV’Aids has not helped one whit, nor has any manufacturing of significance developed. Unsurprisingly then, the government employs 30% of the active workforce [3]. In effect , the government has become the funnel moving value from the mining to the people. One measure, that of expenditure on education relative to income, leaves Botswana one of the highest in the world. Try looking here, at inequality adjusted index. Botswana 101st, RSA 113th, (Mauritius 65th, Algeria 85th, Tunisia 95th, Libya 108th) everywhere else in Africa worse than RSA, unless I missed one.

This last image comes from [6]. I found a much better way to explore this, by going to the IMF website and playing with the IMF datamapper. I may publish something made by me at some point, but at the moment I think I’d rather see if there is any reaction. In a sense, I’ve chased this idea long enough.