Wealth Issues. Wealth and Advantage.

I have been waiting for the publicvation of the report (one of several) on the concept of a wealth tax. While waiting I've written little bits already. Some of the issues are in this nest of uncomfortable questions:-

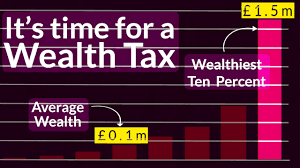

Suppose there was to be a wealth tax. Would you support it if you too were going to be hit by it? How do you begin to accept that you have been holding advantage? Do you (or do I for that matter) fail to recognise the advantages of birth? To what extent was it really your own effort that moved you from the have-nots to the haves? How might you (ever) recognise that you manged to switch from one to the other? How much would a wealth tax be expected to raise before it met with your approval?

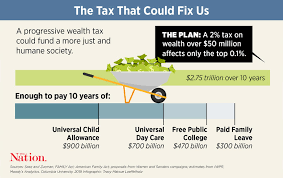

If a wealth tax were to raise 250 billion across five years, would that make a significant difference to the nation, assuming other taxes stayed the same?

Will the Conservatives, eager to somehow 'buy' votes in the next election, look for something that is the opposite of this? A likely candidate for such a thing would be inheritance tax, something which raises about 7 Billion sterling a year but which few of us actually claim. Indeed, a couple can pass over about a million before losing any tax – it is paid by the inheritors at the point when they're due to collect. This would be something that few would affect but many would think is a 'good idea' about which they feel positive. Weird, I call it.

I am quite surprised that I have somehow read most of the content already. That is mostly because essay 366 had lost its links. Other related essays are §388.5, §258 and §241

§388.5 The Party of Tax and Spend

§366 Wealth Tax

§364 Renting is Throwing Money Away

§353.3 Zero-sum

§258 The Resource Curse

§241 The Middle Class

More than 60% of those born in the 1950s and 1960s were homeowners by age 30, but only 36% of those born in the 1980s were.

https://ifs.org.uk/inequality/trends-in-income-and-wealth-inequalities/

https://www.wealthandpolicy.com/wp/WealthTaxFinalReport_ExecSummary.pdf(11 pages)

This concludes that an annual wealth tax is a non-starter in the UK and we should fix our existing taxes on wealth instead. However, a one-off wealth tax is a very different proposition.

https://www.wealthandpolicy.com/wp/WealthTaxFinalReport.pdf (125 pages)

Swapped to Arial 18, 20230315